The Trump administration continues to downplay the risks associated with artificial intelligence (A.I.), a stance that has sparked concern among economists. As discussions around the implications of A.I. on the economy intensify, the administration maintains a focus on the positive aspects, such as increasing stock prices and accelerating economic growth. Yet, prominent economists have raised alarms about potential mass job losses and the risk of a financial bubble fueled by unchecked technological advancements.

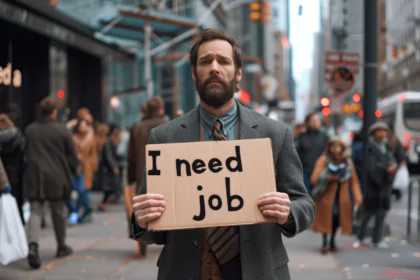

Despite these warnings, President Trump has been vocal in his support for the tech sector, highlighting its role in driving economic expansion. The administration’s optimism contrasts sharply with the growing unease among labor market experts and financial analysts who caution that without proper regulation and oversight, A.I. could lead to significant disruptions in employment and market stability. As companies increasingly adopt automation and A.I. technologies, the potential for widespread job displacement becomes a pressing issue.

Critics argue that the administration’s approach could result in a dangerous oversight of the potential risks, which, if left unaddressed, might culminate in a significant economic fallout. The juxtaposition of soaring stock prices against the backdrop of these risks raises questions about the sustainability of current market trends. Economists suggest that while innovation is essential for growth, it is equally important to consider the societal implications of such rapid technological advancements.

Furthermore, the possibility of a financial bubble looms large as investment in A.I. technologies surges. History has shown that unregulated markets can lead to catastrophic consequences, and many fear that the current trajectory may be repeating past mistakes. The administration’s dismissal of these concerns could have long-term repercussions for both the labor market and economic stability.

As stakeholders in the economy watch closely, the call for a balanced approach to A.I. regulation grows louder. The need for a framework that promotes innovation while safeguarding against potential risks is becoming increasingly urgent. In light of these discussions, it remains to be seen whether the administration will adjust its stance and take heed of the warnings from economists.

For more in-depth financial analysis and updates, explore our Financial News section.