Tax-Related Banking Issues

Tax-Related Banking Issues

Navigating tax-related banking issues can be complex, yet it’s a crucial aspect of financial management. This category offers comprehensive insights and guidance on various topics intertwined with taxation and banking, catering specifically to the U.S. banking market.

Understanding Tax Implications on Bank Accounts Explore the impact of different types of bank accounts on your tax obligations. Learn how interest earned from savings accounts, CDs, and other interest-bearing accounts is taxed. Understand the reporting requirements for interest income and how it affects your overall tax liability.

Tax Benefits of Different Savings Accounts Discover the tax advantages of specific savings vehicles like IRAs, Roth IRAs, 401(k)s, and Health Savings Accounts (HSAs). Detailed comparisons help you choose the best account to minimize tax burdens while maximizing savings for retirement or medical expenses.

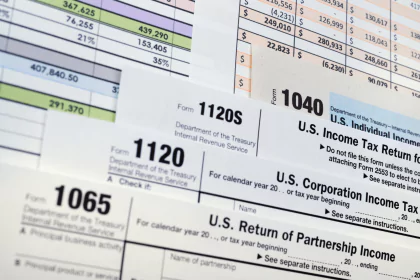

Managing Tax Documents and Reporting Gain knowledge on essential tax documents such as 1099-INT, 1099-R, and other forms that banks issue. Tips on organizing and managing these documents ensure you are prepared for tax season. Learn how to report bank-related income correctly to avoid penalties.

Strategies for Tax-Efficient Banking Explore strategies to manage your banking activities in a tax-efficient manner. This includes choosing the right accounts, understanding tax implications of various financial products, and timing income and withdrawals to optimize tax outcomes.

Tax Planning with Investment Accounts Understand how investment accounts held at banks, such as brokerage accounts, mutual funds, and bonds, interact with your tax situation. Learn about capital gains, dividends, and the impact of buying and selling investments on your taxes.

Foreign Accounts and FATCA Compliance For those with foreign bank accounts, understanding the Foreign Account Tax Compliance Act (FATCA) is critical. This section covers reporting requirements, potential penalties, and strategies to ensure compliance with U.S. tax laws.

Estate Planning and Taxes Learn how to manage your bank accounts in the context of estate planning. Topics include the tax implications of inheriting bank accounts, setting up trusts, and strategies for minimizing estate taxes.

Small Business Banking and Taxes For entrepreneurs and small business owners, managing taxes related to business bank accounts is vital. This section offers guidance on deductible banking fees, managing business expenses, and optimizing your banking setup for tax efficiency.

Tax Implications of Loans and Mortgages Explore how various loans and mortgages affect your tax situation. Understand the deductions available for mortgage interest, the tax impact of loan forgiveness, and strategies for managing debt in a tax-efficient manner.

Digital Banking and Tax Considerations With the rise of digital banking, it’s essential to understand the tax implications of using online banks, mobile banking apps, and digital wallets. Learn about the reporting requirements and tax treatment of transactions made through these platforms.

Compliance and Regulatory Updates Stay updated with the latest changes in tax laws and regulations affecting banking. This section provides timely information on new legislation, IRS guidelines, and other regulatory updates to ensure you remain compliant and informed.

Practical Tips and Expert Advice Access practical tips and expert advice to manage your banking and taxes more effectively. From tax-saving strategies to common pitfalls to avoid, this section equips you with the knowledge needed to make informed financial decisions.

By exploring these topics, readers will gain a thorough understanding of how to manage their banking activities to minimize tax liabilities and optimize financial outcomes. The content is designed to be practical, insightful, and directly applicable to everyday banking and tax planning scenarios.