Wealth management is a cornerstone of financial planning for individuals and families looking to secure their financial future. With a plethora of services designed to cater to high-net-worth individuals, Bank of America stands out as a leading provider of wealth management solutions. This article delves into the comprehensive wealth management services offered by Bank of America, highlighting the various products, tools, and personalized services available to help clients achieve their financial goals.

Introduction to Wealth Management

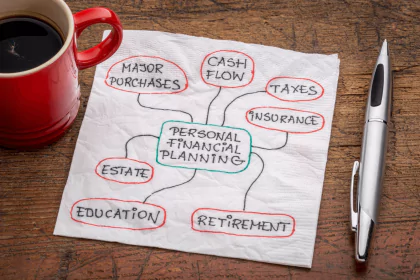

Wealth management encompasses a wide range of financial services tailored to meet the needs of affluent individuals. It includes investment management, financial planning, estate planning, tax services, and retirement planning. At Bank of America, these services are integrated to provide a holistic approach to managing and growing wealth.

Understanding Wealth Management

Wealth management is more than just investment advice; it encompasses all parts of a person’s financial life. The idea is to provide a comprehensive service to manage clients’ wealth, covering everything from managing investments and estate planning to providing tax advice and financial planning.

The Importance of Wealth Management

Effective wealth management helps individuals and families preserve and grow their wealth, plan for future needs, and achieve their long-term financial goals. It provides peace of mind by ensuring that all aspects of one’s financial life are aligned and optimized.

Effective wealth management helps individuals and families preserve and grow their wealth, plan for future needs, and achieve their long-term financial goals.

Bank of America’s Wealth Management Services

Bank of America, through its subsidiary Merrill Lynch Wealth Management, offers a suite of wealth management services. These services are designed to provide personalized solutions to help clients manage their financial lives comprehensively.

Investment Management

Investment management is a critical component of wealth management. Bank of America offers a range of investment options, including:

- Equities: Investing in stocks to potentially gain from market growth.

- Fixed Income: Bonds and other fixed-income securities to provide steady income.

- Mutual Funds: Diversified portfolios managed by professional fund managers.

- ETFs: Exchange-traded funds that offer diversified exposure to various market sectors.

- Alternative Investments: Hedge funds, private equity, and other non-traditional investments for portfolio diversification.

Financial Planning

Financial planning is about setting goals and creating a roadmap to achieve them. Bank of America provides comprehensive financial planning services that include:

- Retirement Planning: Strategies to save for and transition into retirement.

- Education Planning: Saving for children’s education expenses.

- Cash Flow Management: Budgeting and managing income and expenses.

- Risk Management: Insurance and other strategies to protect against unforeseen events.

Estate Planning

Estate planning ensures that wealth is transferred according to the client’s wishes and in the most tax-efficient manner possible. Services include:

- Wills and Trusts: Creating legal documents to manage the distribution of assets.

- Charitable Giving: Strategies for donating to charities in a tax-efficient way.

- Succession Planning: Planning for the transition of business ownership or leadership.

Tax Services

Effective tax management can significantly impact wealth preservation. Bank of America’s tax services include:

- Tax Planning: Strategies to minimize tax liabilities.

- Tax Preparation: Assistance with preparing and filing tax returns.

- Tax Advisory: Advice on the tax implications of various financial decisions.

Retirement Planning

Planning for retirement is a crucial aspect of wealth management. Bank of America offers:

- 401(k) Plans: Employer-sponsored retirement plans.

- IRAs: Individual Retirement Accounts for additional retirement savings.

- Pension Plans: Strategies for managing pension income.

- Annuities: Products that provide guaranteed income in retirement.

Personalized Services

Bank of America prides itself on offering personalized wealth management services. Advisors work closely with clients to understand their unique needs and tailor solutions accordingly. This personalized approach includes:

- Dedicated Advisors: Each client is assigned a dedicated advisor.

- Customized Portfolios: Investment portfolios tailored to individual risk tolerance and goals.

- Regular Reviews: Ongoing reviews to adjust strategies as needed.

The Role of Merrill Lynch Wealth Management

Merrill Lynch Wealth Management, a subsidiary of Bank of America, is a premier provider of wealth management services. With a legacy of excellence and a commitment to client success, Merrill Lynch offers unparalleled expertise and resources.

Merrill Lynch Wealth Management Services

Merrill Lynch offers a broad array of services, including:

- Investment Advisory: Professional advice on investment strategies.

- Wealth Structuring: Techniques to structure wealth for maximum benefit.

- Philanthropic Services: Guidance on charitable giving strategies.

- Family Office Services: Comprehensive management of family wealth.

The Merrill Lynch Approach

The approach at Merrill Lynch is client-centric, focusing on understanding the unique needs and goals of each client. This involves:

- Holistic Planning: Considering all aspects of a client’s financial life.

- Customized Solutions: Tailoring strategies to meet specific objectives.

- Proactive Management: Regularly reviewing and adjusting plans to stay on track.

Case Studies and Success Stories

To illustrate the impact of Bank of America’s wealth management services, let’s look at a few hypothetical case studies.

Wealth management is crucial for individuals and families to maintain and expand their wealth, prepare for future expenses, and meet their long-term financial objectives.

Case Study 1: Retirement Planning

John and Jane Doe, a couple in their mid-50s, sought help from Bank of America to plan for their retirement. They wanted to ensure they could maintain their lifestyle and leave a legacy for their children. Through comprehensive retirement planning, including maximizing their 401(k) contributions, opening IRAs, and investing in annuities, Bank of America helped them build a robust retirement plan. Today, they are on track to retire comfortably and have peace of mind knowing their future is secure.

Case Study 2: Business Succession Planning

Michael Smith, a successful entrepreneur, wanted to transition his business to his children while minimizing tax implications. Bank of America’s wealth management team helped him develop a succession plan that included setting up a family trust, transferring ownership shares gradually, and implementing tax-efficient strategies. The result was a smooth transition that preserved the business’s value and reduced tax liabilities.

Real Links and Resources

For more information on Bank of America’s wealth management services, visit their official Wealth Management page. To explore the services offered by Merrill Lynch Wealth Management, you can visit the Merrill Lynch website.

Contact Information

To speak with a wealth management advisor, you can contact Bank of America at:

- Phone: 1-800-432-1000

- Email: wealthmanagement@bankofamerica.com

- Address: Bank of America, 100 N Tryon St, Charlotte, NC 28255

Conclusion

Wealth management is a vital service for individuals looking to secure their financial future. Bank of America, through its comprehensive suite of services, provides tailored solutions to meet the diverse needs of its clients. By integrating investment management, financial planning, estate planning, tax services, and retirement planning, Bank of America ensures that clients can achieve their financial goals and enjoy peace of mind. Whether you are planning for retirement, managing your investments, or looking to leave a legacy, Bank of America’s wealth management services offer the expertise and resources to help you succeed.