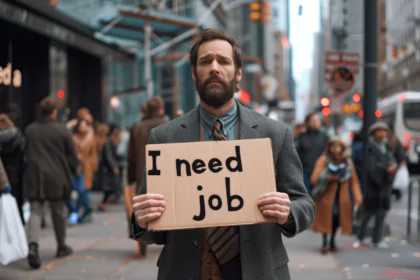

The affordability crisis in the housing market has driven more people towards renting, leaving landlords and investors thriving. The situation, which has worsened since the pandemic, is characterized by high home prices and mortgage rates, making homeownership a distant dream for many.

As home buying becomes increasingly unattainable, renting emerges as the primary alternative. This shift has significantly benefited the rental market, according to Morgan Stanley’s head of global listed real assets, Laurel Durkay. In a recent interview with CNBC, Durkay highlighted how the affordability crisis is creating opportunities for rental landlords to fill the gap left by prospective homebuyers.

The affordability crisis in the housing market is creating opportunities for rental landlords to fill the gap left by prospective homebuyers.

Laurel Durkay, Morgan Stanley Institutional investors, who entered the single-family rental market post-Great Financial Crisis by buying foreclosed homes in bulk, continue to reap benefits. This trend has been amplified by the current unaffordable housing market, making rental properties a lucrative investment. According to Moody’s Analytics Senior Economist Ermengarde Jabir, the single-family rental market remains a “superstar” for investors, as it caters to families seeking the American dream through rental options.

People’s preference for single-family homes with amenities like backyards and proximity to good school districts has sustained demand for rentals. This demand persists despite the high costs of homeownership, which many cannot afford due to the rapid increase in housing prices.

Durkay identified the single-family rental market as the most attractive investment opportunity currently. While multifamily homes also present good investment prospects, the recent surge in multifamily construction, particularly in the Sunbelt, has caused rents to stabilize or even decrease. Despite this, rents remain significantly higher than pre-pandemic levels, and renting is projected to be more affordable than buying for the foreseeable future, especially with home prices continuously reaching new heights.

Institutional landlords, such as American Homes 4 Rent, which operates around 60,000 homes and develops single-family rentals, are benefiting from this trend. Durkay noted that renting an AMH home is approximately 25% more expensive than owning a home in the same markets. This reflects the broader affordability crisis and the significant role institutional investors play in the rental market.

The single-family rental market remains a ‘superstar’ for investors, catering to families seeking the American dream through rental options.

Ermengarde Jabir, Moody’s Analytics AvalonBay, one of the largest apartment owners in the U.S., was also mentioned by Durkay. In AvalonBay markets, the high average home prices make renting a more viable option for many. The disparity between owning and renting in these markets is stark, with owning a home being about 95% more expensive than renting.

While this scenario is advantageous for investors and homebuilders, it presents a complex picture for potential homeowners. Renting provides a temporary solution, but the ultimate goal of homeownership remains out of reach for many, challenging the traditional notion of the American Dream.