In a notable shift, the U.S. job market has seen a significant decline in job openings, marking the lowest level in over three years. This change reflects a gradual slowdown in the labor market, impacting various sectors and providing a critical indicator for economic forecasts.

In April, the number of available positions dropped to 8.06 million, down from 8.36 million in March, according to the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS). This decrease was lower than any economist’s estimate in a Bloomberg survey, underscoring a broad-based decline across several industries.

The gradual slowdown in hiring rather than mass layoffs is a sign that companies are cautious but not in crisis mode

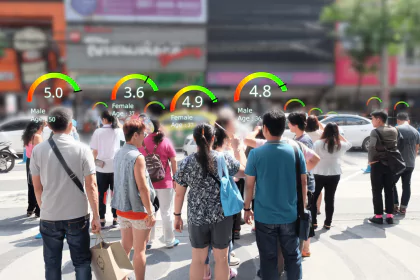

said an economist from the Bureau of Labor Statistics The reduction in job openings has lowered the ratio of vacancies per unemployed worker to its lowest point in nearly three years. This ratio is a key metric monitored by the Federal Reserve to gauge labor market tightness.

The downturn was widespread, with significant drops in health care job openings, which hit their lowest in three years, and manufacturing, which saw the lowest levels since late 2020. Government job openings also showed a decline.

In the accommodation and food services sector, job openings decreased, potentially influenced by California’s higher minimum wage laws. Hiring within this industry fell to its lowest point since the pandemic began.

Despite the cooling job market, the trend has been gradual, characterized by slower hiring rates rather than massive job cuts. This development aligns with the Federal Reserve’s aim to manage demand and control inflation without triggering substantial unemployment.

Both hiring and layoffs remained stable, with layoffs still at historically low levels. However, the slower hiring rate suggests that companies feel their current staffing levels are sufficient to meet demand.

The quits rate, which measures voluntary job departures, remained at its lowest level since 2020. This stability might indicate that workers are less confident in finding new employment opportunities, choosing instead to stay in their current positions.

This significant drop in job openings highlights the delicate balance the Federal Reserve aims to achieve in controlling inflation without causing major unemployment

noted a labor market analyst The ratio of job openings to unemployed individuals decreased to 1.2, the lowest since June 2021, a significant drop from its peak of 2 to 1 in 2022. This metric, closely watched by Federal Reserve officials, has shown substantial easing over the past year.

This data precedes the anticipated monthly employment report, which is expected to reveal that the U.S. added 185,000 jobs in May while the unemployment rate stayed consistent.

Economists have raised concerns about the reliability of the JOLTS statistics, partly due to the survey’s low response rate, but the current trends offer valuable insights into the state of the U.S. labor market.