Blockchain technology has profoundly impacted various industries since its inception. What began with Bitcoin has now evolved into a vast ecosystem of decentralized applications, cryptocurrencies, and transformative technologies. This article will provide an in-depth exploration of blockchain technology’s evolution, its impact on the financial sector, and its future potential.

Introduction: The Rise of Blockchain Technology

Blockchain technology, initially introduced through Bitcoin, has become a cornerstone of modern digital innovation. It offers a secure, transparent, and decentralized way to record transactions and data, making it a crucial element in the digital transformation of numerous industries.

What is Blockchain?

Blockchain is a decentralized digital ledger that records transactions across a network of computers. This ensures that the recorded information is secure, transparent, and immutable, meaning it cannot be changed once recorded. This technology underpins cryptocurrencies like Bitcoin and enables the creation of smart contracts, decentralized applications (dApps), and much more.

The Birth of Bitcoin

Bitcoin, introduced in 2008 by an anonymous individual or group known as Satoshi Nakamoto, was the first practical application of blockchain technology. Designed as a peer-to-peer electronic cash system, Bitcoin allows users to send and receive digital currency without needing a central authority, such as a bank.

Key Features of Bitcoin:

- Decentralization: The Bitcoin network operates without a central authority, relying on a distributed network of nodes to validate transactions.

- Transparency: All transactions are recorded on a public ledger known as the blockchain, which anyone can view.

- Security: Bitcoin uses cryptographic techniques to secure transactions and control the creation of new units.

Ethereum and Smart Contracts

In 2015, Ethereum introduced a new paradigm to the blockchain world with its support for smart contracts. These are self-executing contracts where the terms of the agreement are directly written into code. This innovation allows for the creation of decentralized applications (dApps) that run exactly as programmed without any possibility of downtime, censorship, fraud, or third-party interference.

Key Features of Ethereum:

- Smart Contracts: These are programmable contracts that automatically execute when predefined conditions are met.

- Ethereum Virtual Machine (EVM): This is the runtime environment for smart contracts in Ethereum. It allows anyone to execute code in a trustless ecosystem.

- ERC-20 and ERC-721 Tokens: These standards allow developers to create their own tokens on the Ethereum network, including fungible tokens (ERC-20) and non-fungible tokens (ERC-721).

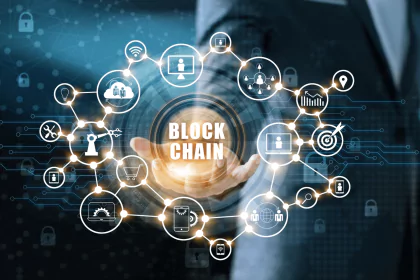

The Evolution to Web3

Web3 represents the third generation of internet services, emphasizing decentralized applications, user privacy, and the integration of blockchain technology. Unlike Web2, which relies heavily on centralized servers and data control by large corporations, Web3 aims to decentralize the internet, giving users greater control over their data and online interactions.

Key Aspects of Web3:

- Decentralized Applications (dApps): These are applications that run on a blockchain or peer-to-peer network instead of being hosted on centralized servers.

- Decentralized Finance (DeFi): This is a financial system built on blockchain technology that eliminates the need for traditional financial intermediaries.

- Non-Fungible Tokens (NFTs): These are unique digital assets that represent ownership or proof of authenticity of a specific item or piece of content on the blockchain.

The Impact of Blockchain on the Financial Sector

Blockchain technology has revolutionized the financial sector, introducing new methods for transacting, investing, and raising capital. Its impact is felt across various areas, including cryptocurrencies, initial coin offerings (ICOs), and decentralized exchanges (DEXs).

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin was the first cryptocurrency, but many others have emerged since, each with unique features and uses.

Initial Coin Offerings (ICOs)

ICOs are a new way for startups to raise capital. By issuing tokens, these startups can attract investors willing to fund their projects. The tokens can be traded on various cryptocurrency exchanges.

Decentralized Exchanges (DEXs)

DEXs allow users to trade cryptocurrencies directly with one another without needing a centralized intermediary. This peer-to-peer trading model enhances security and privacy.

Regulatory Challenges and Future Prospects

Despite its potential, blockchain technology faces significant regulatory challenges. Governments and regulatory bodies worldwide are working to create frameworks that ensure security and compliance while fostering innovation.

Key Regulatory Challenges:

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Ensuring that blockchain-based transactions comply with financial regulations designed to prevent money laundering and fraud.

- Taxation: Defining clear guidelines for taxing cryptocurrency transactions and earnings.

- Data Privacy: Balancing the need for transparency in blockchain transactions with users’ privacy rights.

The Future of Blockchain Technology

The future of blockchain technology looks promising, with ongoing innovations and increasing adoption across various industries. From finance to supply chain management, blockchain’s potential applications are vast and continually expanding.

Key Trends:

- Interoperability: Enhancing communication between different blockchain networks to ensure seamless interaction.

- Scalability: Addressing the scalability issues to handle more transactions per second, making blockchain technology more efficient and practical for widespread use.

- Sustainability: Developing eco-friendly blockchain solutions to reduce the environmental impact of blockchain mining and transactions.

Conclusion

The evolution of blockchain technology from Bitcoin to Web3 marks a significant shift in how we interact with digital services and financial systems. With its potential to enhance security, transparency, and efficiency, blockchain is poised to become a cornerstone of future technological advancements. As we continue to explore and innovate, the impact of blockchain technology will likely extend far beyond what we can imagine today.

Detailed Exploration of Blockchain Technology

Bitcoin: The First Cryptocurrency

Bitcoin was the first cryptocurrency, and its creation marks the beginning of blockchain technology’s journey. It was designed to offer an alternative to traditional financial systems, allowing users to transfer value without intermediaries.

How Bitcoin Works

Bitcoin transactions are recorded on a public ledger known as the blockchain. Each transaction is verified by network nodes through cryptography and recorded in a block. These blocks are then linked together in chronological order, forming a chain.

The Role of Miners

Miners play a crucial role in the Bitcoin network. They solve complex mathematical problems to validate transactions and add them to the blockchain. In return, they are rewarded with new bitcoins and transaction fees.

Ethereum: Beyond Cryptocurrency

While Bitcoin is primarily a digital currency, Ethereum extends blockchain technology to include smart contracts and decentralized applications.

The Ethereum Virtual Machine (EVM)

The EVM is the environment where all Ethereum accounts and smart contracts live. It ensures that smart contracts are executed exactly as programmed without any possibility of fraud or third-party interference.

Ethereum’s Impact on Decentralized Finance (DeFi)

Ethereum has been a driving force behind the DeFi movement, which aims to create a more open, transparent, and accessible financial system. DeFi platforms enable users to lend, borrow, trade, and invest in a decentralized manner.

Smart Contracts: The Backbone of Decentralized Applications

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute and enforce the contract terms when certain conditions are met.

Advantages of Smart Contracts

- Automation: Smart contracts automate processes, reducing the need for intermediaries and minimizing the risk of human error.

- Security: Smart contracts are secure and tamper-proof, ensuring that agreements are honored.

- Transparency: All parties can see the terms of the contract and how it is executed, enhancing trust.

Decentralized Finance (DeFi): Revolutionizing Financial Services

DeFi refers to a system of financial applications built on blockchain technology that operates without traditional financial intermediaries.

Key Components of DeFi

- Lending and Borrowing: Platforms like Aave and Compound allow users to lend and borrow cryptocurrencies.

- Decentralized Exchanges (DEXs): Uniswap and SushiSwap enable users to trade cryptocurrencies directly with each other.

- Stablecoins: Cryptocurrencies like DAI and USDC are pegged to stable assets like the US dollar, providing stability in the volatile crypto market.

Non-Fungible Tokens (NFTs): Unique Digital Assets

NFTs are digital assets that represent ownership or proof of authenticity of a specific item or piece of content. They are unique and cannot be exchanged on a one-to-one basis like cryptocurrencies.

Applications of NFTs

- Art: Artists can tokenize their work, allowing them to sell it directly to buyers without intermediaries.

- Gaming: NFTs can represent in-game assets, giving players true ownership of their virtual items.

- Real Estate: NFTs can be used to represent ownership of physical properties, simplifying the buying and selling process.

Regulatory Landscape of Blockchain Technology

As blockchain technology continues to grow, so does the need for regulatory frameworks to ensure its safe and compliant use.

Global Regulatory Approaches

Different countries have taken varying approaches to blockchain regulation. While some have embraced the technology, others have imposed strict regulations to control its use.

- United States: The US has a complex regulatory landscape for blockchain and cryptocurrencies, with multiple agencies like the SEC, CFTC, and FINRA involved.

- European Union: The EU has been proactive in creating a unified regulatory framework for blockchain and cryptocurrencies, aiming to foster innovation while ensuring consumer protection.

- Asia: Countries like China and Japan have taken different approaches, with China imposing strict regulations and Japan being more open to blockchain innovation.

Challenges and Opportunities in Blockchain Adoption

Despite its potential, blockchain technology faces several challenges that need to be addressed to ensure its widespread adoption.

Scalability

Scalability is one of the biggest challenges facing blockchain technology. The ability to process a large number of transactions per second is crucial for mainstream adoption.

Interoperability

Interoperability between different blockchain networks is essential for creating a cohesive ecosystem. Efforts are underway to develop solutions that enable seamless interaction between various blockchains.

Security

While blockchain technology is inherently secure, it is not immune to attacks. Ensuring the security of blockchain networks and smart contracts is vital for maintaining trust in the system.

Future Trends in Blockchain Technology

As blockchain technology continues to evolve, several trends are emerging that will shape its future.

Integration with Other Technologies

Blockchain is being integrated with other emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and big data to create more powerful and innovative solutions.

Privacy and Confidentiality

Efforts are being made to enhance privacy and confidentiality in blockchain transactions. Solutions like zero-knowledge proofs and confidential transactions are being developed to address these concerns.

Sustainability

With growing concerns about the environmental impact of blockchain mining, there is a push towards more sustainable blockchain solutions. Initiatives like Ethereum’s transition to proof-of-stake and the development of eco-friendly mining practices are steps in this direction.

Conclusion

The evolution of blockchain technology from Bitcoin to Web3 marks a significant transformation in how we interact with digital services and financial systems. With its potential to enhance security, transparency, and efficiency, blockchain technology is poised to become a cornerstone of future technological advancements. As we continue to explore and innovate, the impact of blockchain technology will likely extend far beyond what we can imagine today.