In today’s digital age, online banking has become a vital part of our financial lives. But have you ever wondered what makes it so essential beyond the obvious conveniences? Let’s explore five little-known benefits of online banking that you need to know about.

Introduction

Is your bank’s physical branch no longer as essential as it once seemed? Online banking’s growing popularity suggests that it might not be. With the convenience of managing finances from your smartphone or computer, many people have transitioned to online banking. But beyond the evident ease of access and 24/7 availability, what are the lesser-known benefits that make online banking an even more attractive option? In this article, we’ll delve into five surprising advantages that could transform your perspective on online banking.

1. Enhanced Financial Management Tools

One of the most underrated benefits of online banking lies in its advanced financial management tools. These tools are designed to give users better control and oversight of their finances.

Budgeting Made Easy

Online banking platforms often come equipped with robust budgeting tools that help track your spending habits. By categorizing your expenses, these tools allow you to see where your money goes each month. This feature can be a game-changer for anyone looking to save money or manage their budget more effectively.

Automatic Savings Plans

Another fantastic feature is the ability to set up automatic savings plans. These plans can be tailored to move a certain amount of money from your checking account to your savings account at regular intervals. For example, you can set up a plan to save a portion of your paycheck automatically, ensuring that you’re consistently putting money aside for future needs without having to think about it.

Real-Time Financial Insights

Real-time insights into your financial status can also be a significant advantage. Many online banking platforms offer dashboards that provide a snapshot of your financial health, including your account balances, upcoming bills, and spending trends. These insights help you make informed decisions about your finances and can alert you to any suspicious activity in your accounts.

“By providing real-time insights and comprehensive budgeting tools, online banking can help users make smarter financial decisions,” says John Taylor, a financial analyst at BankOnline USA.

2. Increased Security Measures

Contrary to common concerns, online banking can offer enhanced security features that often surpass those found at traditional bank branches. Learn more about online banking security in Bank of America.

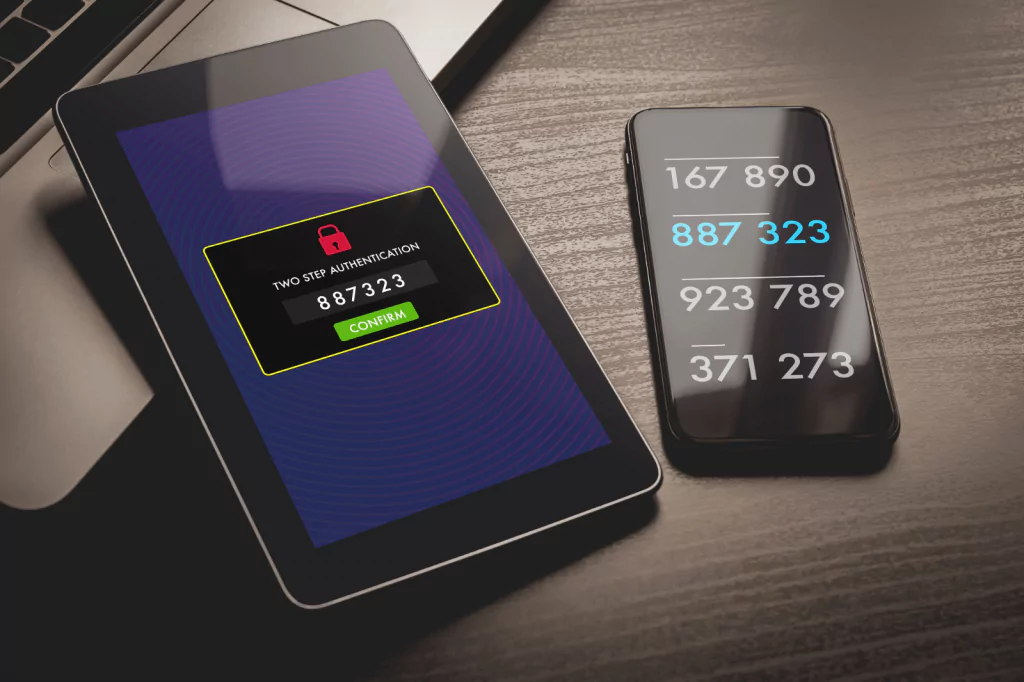

Multi-Factor Authentication

One of the primary security measures is multi-factor authentication (MFA). MFA requires users to provide two or more verification factors to gain access to their accounts. This method significantly reduces the chances of unauthorized access since a potential intruder would need more than just your password.

Advanced Encryption

Online banking systems use advanced encryption technologies to protect your data. This encryption ensures that any information you send to your bank is securely transmitted, making it nearly impossible for hackers to intercept your data.

Instant Fraud Alerts

Online banking platforms also provide instant fraud alerts. These alerts notify you of any suspicious activity on your account, allowing you to act quickly to prevent any unauthorized transactions. Traditional banks may take longer to detect and inform you of such activities, giving online banking a distinct advantage in this regard.

“Enhanced security features such as multi-factor authentication and advanced encryption make online banking a safer option than you might think,” notes Sarah Johnson, a cybersecurity expert.

3. Environmental Benefits of online banking

Online banking isn’t just convenient for you; it’s also better for the environment.

Reduced Paper Usage

By opting for online banking, you contribute to reducing the amount of paper used for statements, bills, and receipts. Electronic statements are not only more secure but also environmentally friendly. This reduction in paper usage can lead to significant environmental savings over time. Read more about the environmental impact of digital banking.

Lower Carbon Footprint

Online banking also reduces the need for physical travel to bank branches, which can lower your carbon footprint. Less driving means fewer carbon emissions, contributing to a greener planet.

Digital Payments

Digital payments and transfers are another eco-friendly aspect of online banking. These transactions eliminate the need for physical checks and cash, further reducing the environmental impact of banking activities.

“Choosing online banking can be a small yet impactful step towards a more sustainable lifestyle,” says environmental economist Dr. Emily Green.

4. Better Interest Rates and Lower Fees

Did you know that online banks often offer better interest rates and lower fees compared to traditional banks?

Higher Interest on Savings

Online banks generally have lower operating costs since they don’t need to maintain physical branches. These savings are often passed on to customers in the form of higher interest rates on savings accounts and certificates of deposit (CDs).

Lower or No Fees

Many online banks also have lower fees or no fees for certain services, such as account maintenance, transfers, and ATM withdrawals. This can lead to substantial savings over time, especially if you frequently use these services.

Competitive Loan Rates

Online banks may offer more competitive rates on loans and mortgages as well. By reducing overhead costs, they can provide better terms to borrowers, making online banking a cost-effective option for those in need of financing.

“Online banking often translates into financial savings for customers, thanks to higher interest rates and lower fees,” explains financial advisor Laura Smith.

5. Greater Accessibility and Convenience

The convenience and accessibility of online banking go beyond just the ability to bank from anywhere.

Banking Without Boundaries

Online banking allows you to manage your accounts from virtually anywhere in the world. Whether you’re traveling for work or vacationing, you can access your finances without the need to find a local branch.

24/7 Availability

With online banking, you’re no longer restricted by traditional banking hours. You can perform transactions, check your balance, or apply for loans at any time of day or night. This 24/7 availability ensures that you have control over your finances whenever you need it.

Comprehensive Services

Online banks offer a comprehensive range of services that you might not find at all traditional branches. From digital wallets and investment tools to online customer support, the breadth of services available online can meet virtually all your banking needs. For those looking to start with online banking, here’s a step-by-step guide on how to open a bank account with zero hassle.

“Online banking’s accessibility and comprehensive services make it an essential tool for modern financial management,” states tech expert Robert Adams.

Conclusion

In conclusion, online banking offers several little-known benefits that can significantly enhance your financial management, security, and convenience. From advanced budgeting tools and increased security measures to environmental benefits, better interest rates, and unparalleled accessibility, online banking provides numerous advantages that traditional banking cannot match. As we continue to embrace digital solutions in all aspects of our lives, online banking stands out as a vital component of our financial well-being.

FAQ — Popular Questions and Answers

Online banking is very secure, with advanced encryption, multi-factor authentication, and real-time fraud alerts to protect your information.

Yes, online banking allows you to access your accounts from anywhere in the world, as long as you have an internet connection.

Online banking platforms often provide budgeting tools, automatic savings plans, and real-time financial insights to help you manage your money effectively.

Many online banks offer lower fees or no fees for services like account maintenance, transfers, and ATM withdrawals compared to traditional banks.

Online banking reduces paper usage and the need for physical travel to bank branches, lowering your carbon footprint and contributing to environmental sustainability.