In the United States, the journey into the world of credit and financial responsibility begins at a young age. As young Americans seek to establish their financial independence, understanding the age requirements for obtaining credit from major banks becomes crucial. This article delves into the policies of the two largest banks in the U.S., providing a comprehensive overview of when and how the youth can start their credit journey.

The Legal Landscape of Credit in the U.S.:

Credit availability in the U.S. is governed by a complex web of federal and state regulations. The foundational legal age for entering into a binding contract, including credit agreements, is 18. However, the nuances of credit eligibility extend beyond just age.

Major U.S. Banks’ Stance on Youth Credit:

The policies of the two largest U.S. banks serve as a benchmark for the industry. Both banks adhere to federal regulations while offering tailored financial products aimed at empowering young individuals with the tools to build a solid credit foundation.

BUILDING A FUTURE: CREDIT AS A STEPPING STONE FOR THE YOUNG

bankonlineusa.com

- Credit Cards and Loans for Young Adults: The entry point for most young Americans into the world of credit is often through secured credit cards or student loans. These products are designed to cater to individuals with minimal or no credit history, providing a pathway to creditworthiness.

- Co-Signing and Joint Accounts: For individuals under 18, major banks offer the option of co-signed accounts or becoming authorized users on a parent’s account. This approach not only facilitates financial access but also instills responsible credit habits under the guidance of a guardian.

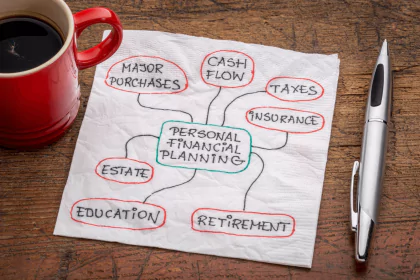

Financial Literacy and Youth Empowerment:

Both leading banks emphasize the importance of financial education. By offering resources and programs tailored to young clients, these institutions aim to equip the next generation with the knowledge to make informed financial decisions.

Photo Placement: An engaging image of a financial literacy workshop for teens, highlighting the educational efforts by banks.

Challenges and Considerations:

Navigating the credit landscape can be daunting for young individuals. This section addresses common challenges, such as understanding credit scores, managing debt, and the importance of financial prudence.

Frequently Asked Questions (FAQs):

In the United States, you can apply for your own credit card once you turn 18. However, approval will depend on various factors, including your income and credit history. For those without a credit history, secured credit cards or becoming an authorized user on a parent’s account are viable starting points.

A secured credit card requires a cash deposit that serves as collateral and typically determines your credit limit. It’s an excellent tool for building credit, as the bank reports your payment activity to the credit bureaus, helping establish a credit history.

Yes, young adults can obtain loans, but the types of loans and approval criteria can vary. Student loans are the most accessible type for college-bound young adults, while auto loans or personal loans may require a co-signer or proof of income.

Building a steady income, maintaining a low debt-to-income ratio, and ensuring any existing credit is managed responsibly can improve your creditworthiness. Additionally, regularly checking your credit report for errors and being an authorized user on a parent’s credit card can help build your credit history.

Conclusion:

The journey to financial independence is both exciting and challenging for young Americans. Major U.S. banks play a pivotal role in this journey, offering tailored products and educational resources that pave the way for a healthy financial future. As the landscape of credit and banking continues to evolve, staying informed and proactive remains key to achieving financial success.

Photo Placement: A hopeful image of a young individual looking towards a bright financial future, symbolizing the potential and opportunities ahead.

Actionable Steps for Young Americans:

As you embark on this financial journey, remember that the road to creditworthiness and financial independence is a marathon, not a sprint. Here are a few actionable steps to set you on the right path:

- Educate Yourself: Take advantage of the wealth of financial education resources provided by banks, schools, and online platforms. Knowledge is your greatest asset.

- Start Early: Even if you’re not ready to apply for a credit card or loan, you can begin building your financial understanding and habits now.

- Budget Wisely: Learn to manage your finances by creating and sticking to a budget. This foundational skill will serve you well throughout your financial journey.

- Seek Guidance: Don’t hesitate to ask for advice from financial professionals, family members, or mentors who have experience in managing credit and finances.

Final Thoughts:

The path to financial empowerment for young Americans is filled with opportunities and challenges. By taking proactive steps towards understanding and managing credit, you’re laying the groundwork for a prosperous future. Major U.S. banks, with their comprehensive range of services and educational initiatives, are valuable partners in this journey. Embrace the journey, stay informed, and take charge of your financial destiny.